Content

If the court issued an order of distribution during that period, you must submit a certified copy of the order as part of the evidence. The date of death value, entered in the appropriate value column with items of principal and includible income shown separately. You may make a protective alternate valuation election by checking “Yes” on line 1, writing the word “protective,” and filing Form 706 using regular values. Mother of Simplified Accounting If all four conditions above are met, do not include these gifts on line 4 of the Tax Computation and do not include the gift taxes payable on these gifts on line 7 of the Tax Computation. When you complete the return, staple all the required pages together in the proper order. A gross valuation understatement occurs if any property on the return is valued at 40% or less of the value determined to be correct.

Any transfer within 3 years of death of a retained section 2036 life estate, section 2037 reversionary interest, or section 2038 power to revoke, etc., if the property subject to the life estate, interest, or power would have been included in the gross estate had the decedent continued to possess the life estate, interest, or power until death. If this election was made and the surviving spouse retained interest in the QTIP property at death, the full value of the QTIP property is includible in the estate, https://simple-accounting.org/ even though the qualifying income interest terminated at death. It is valued as of the date of the surviving spouse’s death, or alternate valuation date, if applicable. Do not reduce the value by any annual exclusion that may have applied to the transfer creating the interest. If you are required to file Form 706, complete Schedule E and file it with the return if the decedent owned any joint property at the time of death, whether or not the decedent’s interest is includible in the gross estate.

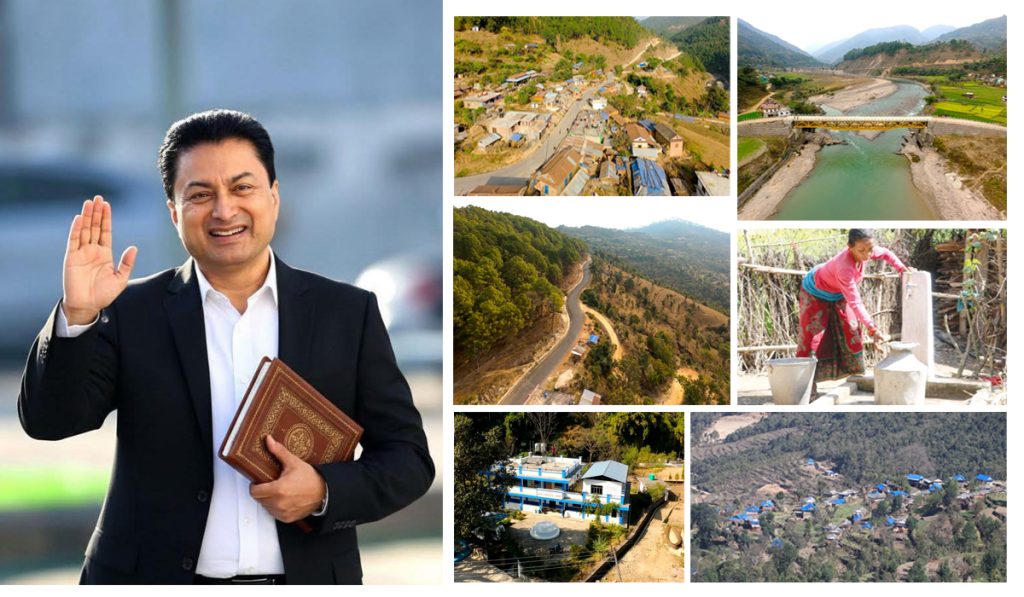

CPA at Simplified Accounting & Tax

“Great support and reference resource, simple explanations for odd infrequent transactions or questions. Would recommend to anyone with an accounting Job.” “AccountingCoach is a very useful source of knowledge. I use it not only when I want to recall what I learned, but also to learn things that I do not know and still need at work. The links to the relevant topics are extremely helpful. I have recommended AccountingCoach many times to my colleagues and friends. Best wishes to the great team of professionals.” “Reading and going through the concepts on AccountingCoach is really worth the time. It helped me understand accounting in the correct perspective. Thank you AccountingCoach and all the concerned individuals behind it for making the great effort of sharing this knowledge.” “I am really grateful to AccountingCoach because the questions and the outline in this website has helped me improve my accounting knowledge. I did not read accounting as a full course, but working with your website has made it possible for me to do accounting operations and this is helping me in running my business. Thanks.” “After finishing my accounting program, I felt prepared to tackle any job my supervisor gave me, though in many cases I needed to refresh some concepts. AccountingCoach helps me when I have some questions. I used it almost every day and I take the quizzes to refresh my knowledge.” “The interactive process of research and learning from AccountingCoach has been a great tool for the profession. A great resource and aid in all aspects of accounting, providing the basics for new students as well as a reference for the working professional.”

- If the amount of the claim is the unpaid balance due on a contract for the purchase of any property included in the gross estate, indicate the schedule and item number where you reported the property.

- “Sir, really this is a wonderful site, I sincerely appreciate your effort to share accounting knowledge throughout the world.”

- If the student chooses not to print and send a signature page, or if no printer was available, the processor won’t wait 14 days to print a rejected SAR for the student but will generate one within 72 hours of receiving the data.

- Business or farm debt means only those debts for which the business or farm was used as collateral.

- If the student is unsure about wanting FWS, he or she should answer “don’t know” to still be considered for it; later he or she can decline any aid he or she does not want.

“I have found your seminars and website to be extremely helpful. I am currently a member of the AIPB, but I find your material to be more user friendly and fun to learn.” “Finally, a comprehensive, easy to read, and interesting learning website. I immediately tossed my Accounting books since I’m now hooked and I can’t wait to try all the fun crossword puzzles.” “I just wanted to thank you for the excellent resources here. I’m an absolute beginner in accounting and your site has helped me tremendously.” “I thought that accounting was a very difficult subject, but with the answers I am getting from this site I have entered for a postgraduate course in accounting. Thanks to the AccountingCoach team and all contributors.

K&j Bakery Inc. A Simplified Management

If the charitable transfer was made by will, attach a certified copy of the order admitting the will to probate, in addition to the copy of the will. If the charitable transfer was made by any other written instrument, attach a copy. If the instrument is of record, the copy should be certified; if not, the copy should be verified.

- “I have been a bookkeeper for 6 years now but you know how it is – I can never remember if that is a debit or a credit, LOL. AccountingCoach has helped refresh my skills and learn some new skills that I haven’t needed before. Thanks for the easy learning environment and holding us up to a high standard to earn your certificates.”

- “This site really does wonders overnight! It has been of great help of me! I have excelled in accounting because of this and I’m really grateful.”

- This ensures that the income is properly included in the EFC calculation; for non-tax filers, income earned from work is used in place of the AGI and to determine eligibility for the simplified needs test and automatic zero EFC.

- No organization can survive without adopting his introduced record keeping and double-entry accounting systems and system of accounting cycle which is most widely taught and used in professionals’ organizations and accounts institutions.